Five Factors Affecting Insurance Today

- Natural Disasters and Catastrophic Storm Losses

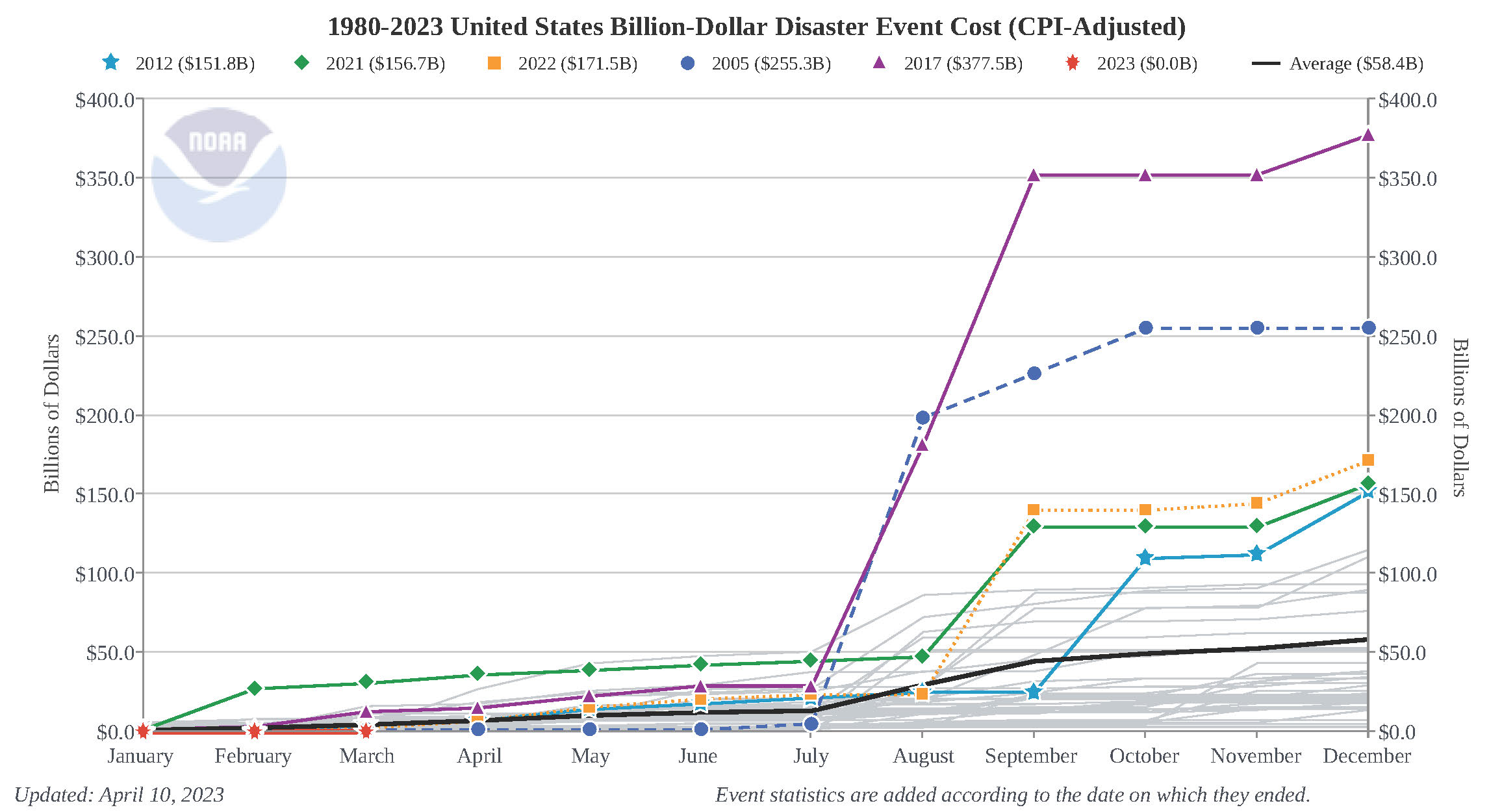

Natural disasters and severe weather have increased significantly in recent years, both globally and in the United States, and insurers expect to see a continuing trend of larger and costlier events. According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. has sustained 341 weather and climate disasters since 1980, where damages and costs reached or exceeded $1 billion each. In the most recent 5 years, occurrence of $1 billion disaster events has more than doubled in frequency as compared to the 42 years from 1980 through 2022. From 1980 through 2022 there were on average 8.1 climate disaster events annually as compared to an average of 218 climate disaster events annually for the five years from 2018 – 2022.

2. Inflation

According to The American Property Casualty Insurance Association (APCIA), the U.S. inflation rate hit a 41-year high of 8% in 2022, peaking at 9.2% last June. Inflation on single-family residential home construction materials has climbed 33.9% since the start of the pandemic, while the cost of trade services is up 27%. Many insurance policies have an inflation factor built in to help increase the insured value of the asset, thereby making the replacement cost more accurate. Several insurance companies have increased their normal 3-4% inflation factor to 8-9% in order to accommodate overall valuation increases.

3. Insurance-To-Value and Underinsurance

Proper Insurance to Value (ITV) is essential in order to have adequate property limits at the time of loss and avoid unexpected out-of- pocket costs. Although inflation factors on insurance policies automatically increase valuations at renewal, it is important to recalculate replacement costs of properties to make sure your unique property can be replaced under current market conditions. According to the Federal Emergency Management Agency (FEMA), an estimated 40% of businesses do not reopen following a major disaster. Another 25% fail within one year, Policyholder Pulse reported in December 2022, much of which can be attributed to not having sufficient insurance coverage.

4. Increased Claims Costs

These factors have consequentially resulted in an increased escalation in the cost of claims. With larger and more frequent claims, adjusters and claims departments are expending a lot more time and resources in settling claims as compared to what has been routine in the past. Supply chain demand for products has also impacted claim settlements as it takes longer to obtain materials to reconstruct damaged or destroyed buildings. Twelve months is rarely, if ever, adequate to indemnify an insured for a large catastrophic loss, contributing to an increased cost of settling claims.

5. Reinsurance Pricing and Capacity

Reinsurance is coverage that an insurance company obtains from a larger insurance company to protect itself from the risk of major claim events. Reinsurers are requiring many property insurance carriers to retain more risk at a higher cost due to less reinsurance capacity. Reinsurance companies are becoming more stringent with underwriting, increasing rates and some are even exiting the reinsurance market altogether, causing increased overall pricing – an expense that directly impacts policyholders.

As our insured, we hope to help you better understand the factors that are currently coming together into what is better known as a “hard market”. During hard market cycles, we normally see overall premium increases, insurance companies not being lenient in underwriting, and a general tightening down of what companies will accept. The good news is that at Hopkins Insurance we are fortunate to represent several top-rated insurance companies that allow us many options to offer you. Working together with you, we are continuing to assess coverage and costs to give you accurate information so that you may make the best decisions possible regarding your insurance protection. Whether the market is hard or soft, we are here to help and are “With you through Life!”

Information from EMC Insurance Article: 5 Trends Impacting Commercial Property Insurance Rates