THE HARD INSURANCE MARKET & HOW OUR AGENCY CAN HELP

The Insurance Industry is currently in what is commonly referred to as a “Hard Market”.

WHAT IS A “HARD MARKET” IN INSURANCE?

A hard market means insurance companies are raising rates and restricting their capacity – their willingness to accept new or increased risk – to insure families and businesses, making it more expensive and difficult to get the coverage you need.

WHAT CAUSES A HARD MARKET?

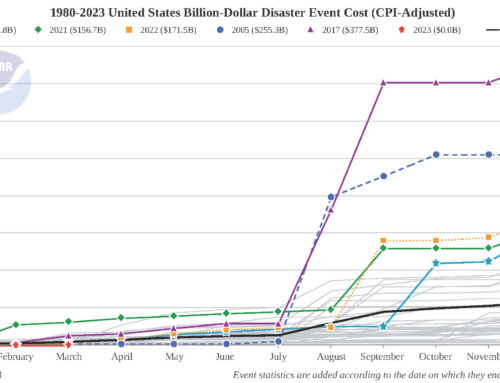

Economic conditions and claims frequency, over time, hurt the insurance industry and create a hard market. When more frequent claims and higher claim payouts occur consistently over a period of time, insurers begin to pull back from markets and increase premiums. Record-setting insured losses from catastrophes, rising inflation, increased labor costs, and supply chain challenges all have contributed to this current hard market. Reinsurance, which is the insurance that insurance companies purchase to transfer some risk, has passed on exponential rate increases due to severe weather events and trends nationwide. In Iowa, some companies have put moratoriums on new business, while others are non-renewing lines of business that they see as high-risk. Most companies are continuing to do business but with stricter underwriting guidelines, resulting in fewer insurers competing for your business and thus driving competition down.

I’VE HAD NO CLAIMS, SO WHY ARE MY PREMIUMS INCREASING?

Premium increases are not just tied to a specific customer’s coverage but to the overall insurance market. Chances are that the insurance value you currently are covering has increased substantially over the past few years due to the increased price of goods. Having no or few claims does benefit you, even if you do not realize it. Customers with low claims experience can be rewarded with claim free discounts. Additionally, it is easier to move to another company without many claims.

WHAT CAN YOU DO TO GET A BETTER RATE?

Here are a few ideas:

1. Increase your deductible. Increasing your deductible is a common way to save premium money.

With asset values higher than ever, an insureds retained risk (the deductible) should also likely be set higher. For example, an asset insured for $100,000 with a $1,000 deductible transfers 99% of the insurable risk to the insurance company. If that same asset is now valued at $200,000, a $2,000 deductible will keep the same percentage of risk assigned to both insurance company and insured.

- Spread the risk. If you are a business or farm, it can be advantageous to spread your assets out over more than one location. Insurers have guidelines for how much value they will insure at one location and not having everything at one location can help in keeping your rates low and looking attractive to companies.

- Add protection devices. Adding devices such as a central fire and burglary alarms can provide additional discounts to your policy.

- Good housekeeping. Keeping your property updated, clean, and free of debris makes your property stand out as one that an insurance company wants to insure.

- Switch to another insurance carrier at Hopkins Insurance – we have lots! Sometimes another carrier may offer the same or better coverage for a more affordable rate. However, switching too often can affect your rates and may cause you to lose some discounts. Nevertheless, changing companies is an option that should be taken into consideration when looking at both pros and cons.

WHAT CAN HOPKINS INSURANCE DO TO HELP YOU IN THIS CURRENT HARD MARKET?

As a Trusted Choice Independent Insurance Agency, we are fortunate to have several contracts with many excellent insurance companies, so we have a lot of options for our clients. Because we have long-standing relationships with insurers, we are well positioned to find coverage for your risks and advocate on your behalf. We are continually keeping our ear to the ground regarding hard market company changes and are adding company options when we believe it will benefit our customers. If the need to change your coverage occurs, we will take time to investigate all of our markets so that we can propose well researched solutions for you.

COMMUNICATE!

Like any adverse market cycle, we are stronger together. Together we will weather this cyclical market condition, which is impacting us all. So please keep us informed of any concerns or new business developments that you may have! We are here for you and “With You Through Life!”